Voters have an opportunity on November 5, 2024, to approve an additional revenue source for Currituck County government. A referendum on the General Election ballot will ask citizens to vote “For” or “Against” implementing a quarter cent local sales and use tax. If voted for, revenue generated by the quarter cent sales tax will fund public safety services.

Background

The Currituck County Board of Commissioners adopted a resolution on July 15, 2024, to conduct the referendum. The North Carolina General Assembly grants counties the authority to levy, subject to voter approval, an additional one-quarter cent county sales and use tax through Article 46 of Chapter 105 of the North Carolina General Statutes. To date, 47 counties in North Carolina have done so. The sales tax rate is currently 6.75%, of which Currituck County receives a 2% share and the state receives 4.75%. If the quarter cent sales tax is voted for, the rate will be 7.00% and Currituck County’s share will increase to 2.25%.

Why implement the quarter cent sales tax?

The Board of Commissioners hopes to ease the county’s reliance on property tax revenue to fund county services. The property tax rate in Currituck County is $0.62 and property tax collections make up 65% of funds in the current year’s operating budget. The quarter cent sales tax can be a resource that prevents, or limits future increases to the property tax rate.

How much will the quarter cent sales tax generate?

The quarter cent sales tax will generate approximately $2,370,000 annually, based on current sales tax collections. By comparison, one penny of Currituck County property tax generates $843,704.

How will the funds be used?

The additional revenue will help meet the needs of public safety services. Examples include maintaining a School Resource Officer position for every school, purchasing new vehicles and apparatus, ensuring competitive salaries for employees, and providing emergency responders with the best life-saving equipment.

Certain purchases are exempt from the quarter cent sales tax.

The quarter cent sales tax will NOT apply to several items such as unprepared food (i.e. groceries), gasoline, prescription medicines, certain agricultural supplies and motor vehicles. For a full list of exemptions, see North Carolina General Statute 105-164.13.

What items are affected?

It will apply to items such as prepared food and drinks (restaurants or stores), clothing, household supplies, and electronics by collecting one penny for every $4 spent.

Using tourism to the county’s advantage.

Nearly 1/3 of all sales tax revenue come from visitors. Currituck’s successful tourism industry annually attracts thousands of people to the county. By implementing the quarter cent sales tax, EVERYONE – residents and visitors – will help fund county services.

What is the voting procedure?

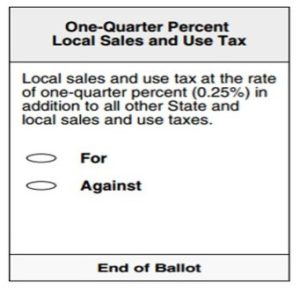

The November 5, 2024, General Election ballot will include the question below. A majority vote in favor of “For” allows the Board of Commissioners to levy the tax.

When will it take effect?

The Board of Commissioners must adopt a resolution to levy the tax and must do so in a public meeting. The Board is required to send certified copies of the resolution and election results to the NC Department of Revenue by December 31, 2024. Currituck County would begin collecting revenue from quarter cent sales tax on April 1, 2025.